How Hospital Cost Structure Is Affected by Demand Uncertainty and Financial Risk

Last Updated April 29, 2021

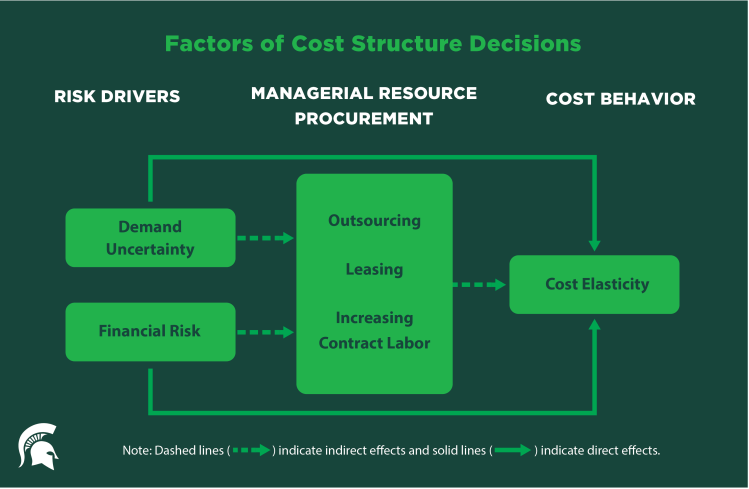

When Faced with High Demand Uncertainty and Financial Risk, Hospitals Increase Cost Elasticity to Mitigate Risk Exposure

Cost structure, which is made up of fixed and variable costs, identifies all the costs and expenses a firm will incur. In their research published in The Accounting Review, Martin Holzhacker and Ranjani Krishnan of Michigan State University and Matthias D. Mahlendorf of the Frankfurt School of Finance & Management analyzed cost structure from a rich data set of 2,202 hospital year observations in the California hospital industry to “unravel the black box of cost behavior” and better understand how hospital managers can influence their mix of fixed and variable cost.

To approximate the cost structure of a firm, the Holzhacker, Krishnan, and Mahlendorf estimated the elasticity of cost, that is the responsiveness of total cost to changes in output. When a cost structure is less elastic, it imposes risk. In particular, if hospital managers are risk averse, they are likely to prefer more elastic cost structures that reduce managerial risk exposure arising from sensitivity of accounting performance measures such as profits to exogenous shocks in volume.

Cost Structure and Risk

The researchers investigated whether hospitals change the cost structure based on two main risk drivers: Demand Uncertainty and Financial Risk.

Demand Uncertainty

“Demand Uncertainty” refers to external factors that cause demand to increase or decrease.

Demand uncertainty imposes profit volatility on a hospital and its decision makers, while high levels of financial risk increase a hospital’s vulnerability to product market shocks, such as economic downturns. Therefore, a less elastic cost structure could be less attractive than an elastic cost structure when hospitals face high demand uncertainty and financial risk because the hospitals run a high risk to incur large losses from the amount of committed costs.

As a result, Holzhacker, Krishnan and Mahlendorf expect decision makers with incentives to limit risk exposure resulting from committed resources to alter resource purchasing choices to increase cost elasticity and protect against higher demand uncertainty and financial risk.

Financial Risk

“Financial Risk” is defined as the potential future inability to cover required financial obligations. Financial risk has direct and indirect consequences for firms in general. Direct consequences include higher cost of capital and legal costs. A few examples of indirect consequences of financial risk include loss of customers, key suppliers and employees that prefer not to deal with a financially distressed firm.

Cost Structure Decisions that Increase Cost Elasticity

In their analysis, Holzhacker, Krishnan and Mahlendorf found that demand uncertainty and financial risk both influence cost elasticity. Hospitals are likely to explore various means to increase their cost elasticity in response to these two risk drivers.

The researchers investigated how demand uncertainty and financial risk impact cost structure decisions by specifically looking at three distinct resource purchasing options: outsourcing, leasing of equipment and hiring contract labor.

They argued that these three resource purchasing decisions can be altered to increase cost elasticity when facing high demand uncertainty and financial risk.

- Outsourcing: Hospitals can use outsourcing to purchase services on a flexible basis instead of installing fixed service capacities onsite.

- Leasing/Renting: Hospitals can lease or rent equipment and reduce profit volatility stemming from committed costs.

- Contract Labor: Hospitals can restructure labor contract (as opposed to fixed-term salaried employees) thereby reducing profit volatility due to committed labor cost.

Managerial Actions that Impact Cost Structure

As Holzhacker, Krishnan, and Mahlendorf demonstrate, concerns about risk exposure from demand uncertainty and financial risk shape hospital managers’ cost structure choices.

Importantly, hospital managers can influence their organization’s cost structure through certain actions that are within their discretion, such as labor outsourcing and contracting, and equipment leasing versus purchasing. Hospital managers and directors must however work within the limits and expectations of key stakeholders, financial structure, and institutional pressures and culture when making such choices.

Overall, cost structure decisions are complex and based on several factors such as, supplier and labor relations, product type or service offered, financial structure and environmental factors, such as competition and regulation.

Holzhacker, Krishnan and Mahlendorf concede that these factors can lead managers to consider other mechanisms to influence cost elasticity not included in their study, and welcome future research that could more systematically investigate the impact of institutional constraints on cost management practices—and on manager decisions related to firm cost structure.